Franking Machines and Shipping Solutions

Stamp down on postal costs with a Mailmark® compliant Franking Machine from Pitney Bowes.

Save 29p on every 1ˢᵗ class and 16p on every 2ⁿᵈ class letter you send*.

Looking for a franking machine?

Simply select your sending volume below to find the best machine to fit your needs.

Sending from 0 to 20 items a day

Explore SendPro® Mailstation

Process light volumes of mail fast, with ink included as standard.

Sending from 20 to 50 items a day

Explore SendPro® C

Process light volumes of mail fast, with ink included as standard.

Sending from 50 to 100 items a day

Explore SendPro®+

Simplifies the way your office sends letters and parcels with Royal Mail® and Parcelforce® Worldwide. Free proof of delivery with every parcel you send.

Sending from 100 to 300 items a day

Explore SendPro® C Auto / SendPro C Auto+

Reduce mail preparation time as you seal and frank your envelopes at the same time. Handle large volumes of mail with the integrated feeder - bringing productivity and ease to the office environment.

Sending from 300 to 1000 items a day

Explore SendPro® P2000

Ideal for all types of businesses, the SendProP2000 is a durable postage solution that automates and simplifies the process of sending different sized mail pieces and shipping parcels.

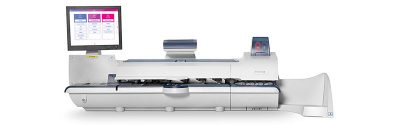

Sending from 1000 items per day and industrial mail

Explore SendPro® P3000

The SendProP3000 machine is our most powerful solution. It is, therefore, suitable for high volume mail processing activities.

When is a franking machine

right for your business?

A simple guide to franking, our e-book will explain the what, why, how and when of franking machines. Learn how you can make your shipping processes faster and save money.

Do you have any questions about franking machines?

We're here to help. Simply contact us by starting a web chat or call 08444 992 992 (then select option: 2 then option 4).

*Save 29p versus Royal Mail® 1st class stamps and save 16p verses Royal Mail® 2nd class stamps with Mailmark® franking machine prices. Savings for other services can be found here. Savings do not include equipment running costs or consumables. No minimum volumes needed (prices correct as of 2nd April 2024).