Rethinking how to grow a small business

This article was originally featured in Strategic Finance magazine.

Business depends on a strong, profitable foundation, but the instability of the last two years has made the strategic role of the management accountant even more integral.

Uncertainty has hindered growth and made forecasting incredibly difficult, especially for small and medium-sized businesses. Not since the Great Depression has there been such an immediate impact on the economic climate as there has been with the COVID-19 pandemic. While the financial crisis of 2007-2009 resulted in losses to gross domestic product (GDP) totaling around $4.6 billion by 2016, its impact was built up over time. By comparison, the United Nations Conference on Trade and Development estimates the cost to the economy caused by the coronavirus outbreak at $1 trillion in 2020 alone.

Private sector growth hit an eight-month low in August 2021 according to the U.S. Composite PMI from IHS Markit. Profitable revenue generation has been inconsistent for many businesses, particularly for small and midsize enterprises, and managing financial targets and budgets has required agility and dexterity.

Now there are expectations to rebuild, strengthen, and grow your organization, as clients and business leaders look to you for direction and resolve. The right finance strategies will help your business, leaving it more resilient and better able to cope with internal and external influences.

CHALLENGING MARKET CONDITIONS

You can control many economic factors internal to your business: organizational investment in people and head count, IT budget and research and development, real estate spend, and marketing and advertising. But the external environment is beyond your control. With the Federal Reserve System beginning to taper its monetary support, we see a number of economic trends emerging that make it more difficult for finance managers to navigate their companies through this period, including:

Emerging COVID-19 variants. Though 60% of the U.S. population is fully vaccinated, the realities of COVID-19 and its threat to normal business operations and our economy remain. The advancement of the Delta strain, the emergence of the Omicron variant, and the unpredictability of new variants have impacted economic expansion and reminded us of the importance of flexibility.

Inflation and the rising costs of living. In June 2021, the cost of living rose by the largest amount since 2008. Finance professionals are closely watching inflation, the personal consumption expenditures price index, and the Federal Reserve’s forecast. Two clear things are emerging. First, managing a business in an environment where inflationary costs are rising disproportionately is becoming increasingly difficult. Second, rising inflation is impacting costs, which is beginning to have a ripple effect on demand. Even before the pandemic, according to a TD Ameritrade financial disruptions survey, 47% of U.S. respondents said that the rising cost of living was the biggest threat to their financial security. While fewer people worldwide are jobless today, many still aren’t earning a living wage when you factor in inflation, which ultimately will have an impact on overall spend.

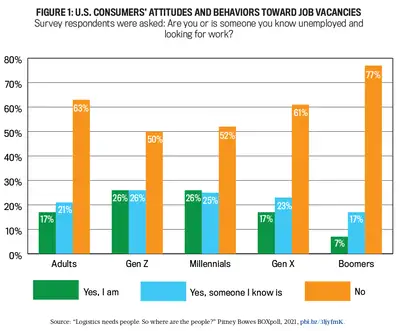

Help wanted. Labor shortages are impacting the economic recovery, with the highest ever number of open jobs in the United States, at 10 million. An aging workforce and lack of skills in some sectors are adding to the pressures. Staffing numbers are rising at the slowest rate since July 2020, and roles across many industries desperately need filling. BOXpoll from Pitney Bowes, the consumer pulse survey, questioned consumers on their attitudes and behaviors toward vacancies (see Figure 1). It found that 62% of respondents who are unemployed would consider a warehouse job or transportation job. When asked what was holding them back from applying:

- 58% said they thought it would be too physically difficult or strenuous.

- 56% felt they weren’t qualified for this line of work.

- 30% thought the work hours and shifts wouldn’t be convenient.

- 23% said the pay wasn’t high enough.

- 17% were concerned about catching COVID-19.

Contrary to opinion, only 15% said that they felt they didn’t need to apply because they currently generate enough income with stimulus and unemployment payments, and only 3% were concerned about childcare. While labor shortages are a significant risk to accelerating recovery, businesses could reconsider their hiring strategies with clarification on roles and expectations to address these concerns and to begin filling vacancies.

Supply chain issues. Product backlogs and shortages impacting manufacturing, production, and global supply chain logistics could hit GDP by 1% this year, according to Goldman Sachs. The ripple effect, says the investment firm, could last well into next year. These shortages are causing disruption to supply chains, adding pressure and squeezing budgets further.

ACCESS TO FINANCING

These factors combine to create a challenging climate to business lending, particularly for small to medium-sized businesses. To grow, your business needs access to financing, and the requirement now is possibly greater than ever before. Small businesses are the engine room of the economy. They’re the main growth driver, a significant contributor to our economic success, accounting for 44% of our economic activity, according to the U.S. Small Business Administration. But this contribution is declining. If small businesses can’t access capital, it inhibits their growth and has the potential to impact our economy.

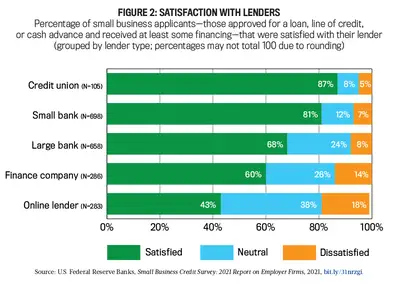

In one study, less than 50% of small businesses said their credit needs were being met. The National Small Business Association found that a quarter of small business owners say they simply can’t obtain the necessary funds to operate their business. For those that did get financing, only 15% of that financing came from large banks, and applicants were most satisfied with credit unions and small banks (see Figure 2). Even before the pandemic, banks’ lending to small businesses was slowing as they favored larger, more profitable loans.

Since March 2020, difficulty accessing credit has exacerbated. Access to capital for small and mid-market businesses has become harder to come by. Small business loan approval rates from large banks were down 50% year over year in November 2020, with large banks approving just 13.2% of applications they receive from small businesses. Smaller banks approved just 18% of business financing applications, compared with 50% in November 2019.

According to Rebel A. Cole, the Lynn Eminent Scholar Professor of Finance in the College of Business at Florida Atlantic University, in 2007, banks held $721 billion in small loans to small businesses and small commercial mortgages. By 2019, these loans had fallen to $680 billion, while contracts, larger business loans, and commercial mortgages doubled.

Widespread bank branch closures make access to small business financing even more challenging. The number of community banks has declined by more than 11,000 over the past 30 years. Some are closing branches in rural locations, and others are closing down altogether. Wells Fargo, Citigroup, and JPMorgan Chase closed more than 250 bank branches in the first half of 2021, with further cuts expected as lenders increasingly shift their customers toward digital services. Self-Financial predicts that bank branches will no longer be around after 2034. Digital channels accounted for 44% of all account openings and loan originations in their most recent quarter, says Bank of America, but many businesses prefer to speak to someone face-to-face about their financing.

POWER UP YOUR BUSINESS

The good news is, despite some of the traditional routes to financing becoming less accessible, there are strategies for your business to manage its financing and access the funds it needs to grow. These include:

- Rethinking your working capital

- Protecting your cash flow

- Diversifying your sources of lending

- Asking your lender the right questions

- Considering equipment financing

Let’s take a closer look at each of these and explore ways you can make adjustments that have a positive impact on your business.

Rethink your working capital. Businesses—small businesses in particular—are permanently being squeezed by increasing costs to their business, impacting liquidity and cash flow. Many are generating fewer sales and less cash from their usual operating activities. At the same time, they’re cutting back on expenditures, letting go of expensive real estate in favor of remote working, renegotiating contracts with vendors, controlling inventory, phasing out manual processes, and streamlining business-critical operations.

These shifts impact working capital. Protecting your working capital is one of the most important financial management strategies that can protect and grow your business. Here are a few things you can do in the new year:

- Make sure your accounts receivable and accounts payable processes are robust and streamlined. Bill as early as possible.

- Analyze metrics from across the business to measure efficiency. Do you have periods of equipment downtime or calls going unanswered at certain times of the day? Are employees spending time problem solving with clients when clients might be just as happy self-serving on a helpful web page?

- Negotiate financial commitments. Longer-term loans, for example, could offer better value. Negotiating better cell phone contracts, broadband, and utilities can be surprisingly effective.

- Source finance to invest in your business. This will help you improve efficiency and maintain a competitive advantage. Invest in technologies that automate processes and make your people productive. Boosting productivity is a strong pathway to growth.

- Work to improve your hiring strategies. Small businesses provide two out of every three jobs in the U.S., yet 83% of small businesses in a Missouri-based Enterprise Bank & Trust study said that finding the right people was their most challenging issue. Organizations must use their culture, innovation, responsiveness, and agility to their advantage. They must maximize their close relationship within the communities they serve and emphasize what makes their business special.

Protect your cash flow. Sixty-one percent of small businesses struggle with cash flow, while 32% have such serious cash flow issues that they can’t pay vendors, pay back loans, or pay themselves or their employees. As a finance professional, you must protect and maintain healthy cash flow for your business.

- Understand your cash flow with a cash flow analysis. Work out your incoming and outgoing cash for the previous six months. Making adjustments—lowering your baseline—will help you plan realistically for the second half of the year. Run a risk assessment on your business. How are your suppliers impacted? How does this affect your ability to generate revenue? What payments do you need to make?

- Control your inventory. Having too much inventory ties up cash. Keep track of inventory so you can estimate your needs better: Do you know how much you have? How much is it worth as an asset?

- Chase outstanding payments. Stay ahead of collections with an accounts receivable aging report as a guide.

- Rethink your lines of credit. Consider if there are different ways you can use existing credit facilities or expand current lines of credit.

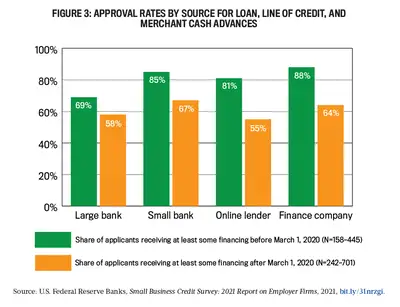

Diversify your sources of lending. Traditionally, many businesses have relied on a single source of capital. They may have felt this easier to manage, or they continue to operate in this way because they’ve always done so. Now, businesses are looking beyond traditional sources to increase their access to capital. They’re diversifying sources of capital and maintaining an integrated network of robust, responsive capital partners, often with a primary lender and a group of secondary, supporting lenders. Approval rates for loans, lines of credit, and merchant cash advances declined after the onset of the pandemic (see Figure 3).

Some businesses are considering neobanks: digital-first banks that offer mobile and online banking through apps and other software. Seven neobanks, or “challenger banks” that operate exclusively online, saw 40% cumulative user growth to 39 million in 2020, including Chime, Acorns, Dave, and Stash. Money Lion grew by 50%, while Varo and Current both recorded 100% growth. Lower monthly fees and simpler, often digital, set-up processes make them an attractive option. But some neobanks don’t have banking licenses. They must partner with a chartered financial institution to be able to take deposits and access the payment system. Many are still in the process of applying for charter, and some don’t yet offer finance, specializing in everyday banking tasks.

As these banks are digital-first, it can be hard to actually speak to someone, and you may not receive the industry expertise you might find in other financial institutions. Whichever lenders you choose, expanding your financing network and creating a financial ecosystem of lenders helps you avoid over-accessing your primary credit facility, ensures you have accessible credit for unforeseen expenses, and allows you to secure capital even when your bank has no more capacity to lend to you. This capital enables you to invest in and grow your business.

Ask your lender the right questions. While stimulus payments may have removed immediate financial pressure from your business, they were designed to get you back on your feet, not to provide long-term support. As you grow your business for the long-term, you need to invest. There are options available to you, but how do you find the right lender? First, you must ask the right questions. Lenders balance risk when they assess your application. Asking them the right questions and providing them with the right information could be the difference between acceptance and rejection of your business loan application.

To help you build a strong, reliable network of financial partners that will support you in the long term and are committed to help you drive growth, there are some important questions you should ask:

- What are their preferences for relationships, compared with individual transactions? Does it feel as though they’re just trying to close a deal with you and rush the process, or do they take time to get to know and understand your business? You want a partner who is truly invested in your success, beyond just the financial capital.

- Do they have a robust history of lending to small businesses? If not, they may not understand the sensitivities and time restrictions that are so important to smaller companies.

- How much capital are they willing to invest, even when markets turn? Do they have swift access to this capital, or do you get the impression that capital will be limited?

- Are they responsive and customer-focused, and do they communicate with you across the channels that work for you? Many secondary lenders differentiate themselves on the customer experience they deliver across multiple channels.

- How flexible are they with their services and terms?

- How well do they understand your specific industry?

- Do you feel they’re truly invested in your success beyond just the financial capital?

Consider equipment financing. Equipment financing is a popular and affordable way of investing in high-value technologies to advance your organization. An estimated $1.8 trillion was expected to be invested by U.S. businesses in plant, equipment, and software in 2019. Around 50% or $900 billion of that is financed through loans, leases, and lines of credit, finds the Equipment Leasing and Finance Association.

A panel led by McKinsey & Company estimated that by 2025, COVID-19 will have cost the rough equivalent to wiping two years of gross income off the average American taxpayer. We need our business community to thrive and to generate long-term, sustainable growth. Your role as a financial professional positions you as the key stakeholder for driving this growth.

Banking products and services are provided by The Pitney Bowes Bank, Inc., Member FDIC. Pitney Bowes, Pitney Bowes Bank, and the Corporate logo are trademarks of Pitney Bowes Inc. or a subsidiary. All other trademarks are the property of their respective owners.