All at once: when consumers, culture, and COVID-19 collide

2020 may be remembered as the year when anyone's guess became good enough. The COVID-19 pandemic, combative election year politics, an historic social justice movement, unprecedented wildfires, devastating hurricanes, an infestation of murder hornets—and more—have coalesced to create a sense of change affecting even the once-mundane parts of our lives. How we work. How we go to school. How we socialize.

And how we buy.

The pace and significance of change happening in our industry has forced consumers to rethink everything they do. This radical shift in consumer habits has challenged us to think differently about how we analyze the market and advise our clients. So, when it came to planning this year's Pitney Bowes Annual Online Shopping Study (the global consumer survey we've published the last seven years), we decided to change...well, everything.

Introducing BOXpoll

Improving the ecommerce order experience is core to everything we do for our clients. Naturally, we want our research to explore a simple question that isn’t as straightforward anymore: what do online shoppers now consider the Best Order eXperience? (That’s BOX for short.)

BOXpoll is a ground-up rethinking of what ecommerce consumer research needs to be today:

- Focusing strictly on ecommerce logistics topics is so last year. How we think about online deliveries & returns is now inextricably intertwined with culture, politics, public health, and the economy. Our research now explores the intersections between these worlds and how they influence each other.

- Annual surveys can't keep up with this quickly shifting ecommerce landscape. So, beginning this month, we're surveying consumers each and every week, and publishing the best of our findings every month.

It used to be easier to draw broad conclusions about the increasing expectations of ‘omnichannel consumers’ (as many industry studies continue to do). This is impractical today, as both consumers and industry insiders are more uncertain than ever about what changes may arrive in the next three—let alone twelve—months. As researchers and ecommerce logistics experts, we (like our clients) all need to ask and listen and learn from the market in real time.

So, we’ve gone Agile (with a capital ‘A’). Our weekly surveys allow us to iterate and learn. We can now test ideas and hypotheses quickly. We’re also asking our clients—many of the fastest-growing ecommerce brands and shippers—to share what they’d like us to ask consumers. As a result, we’re now able to share insights that accommodate the pace of change happening in the market today.

Instead of publishing a study, we’re launching a poll. Pitney Bowes BOXpoll is a weekly consumer survey on current events, culture, and ecommerce logistics. It’s so this year.

The state of the consumer: some of what we’ve learned so far

We know now that ecommerce became a refuge of sorts for consumers who felt wary of entering brick-and-mortar stores early in the COVID-19 pandemic. Now, roughly seven months after widespread quarantine measures were introduced—and weeks if not months after most states lifted some COVID-related restrictions—we asked where consumers see themselves with respect to the pandemic.

What stage of the pandemic is your community in?

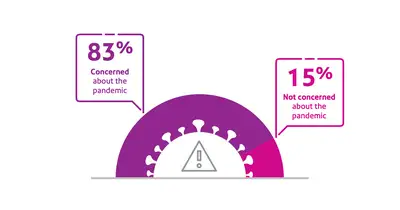

How concerned are you about the COVID-19 pandemic?

1 in 3 consumers see their communities as still in the thick of the pandemic (‘early stages’ or ‘in the midst’). But a far greater number—more than 4 in 5—say they are currently concerned about the pandemic. This led us to ask consumers about their behaviors; what do they plan to do more or less of once the pandemic has passed?

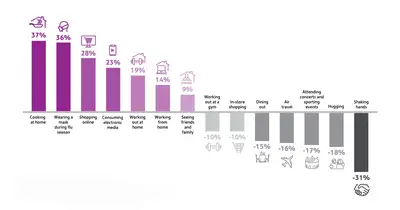

Imagine a post-pandemic world where COVID-19 has been eradicated, all government restrictions have been lifted, and businesses and borders fully reopen. Will you do more, the same, or less of each of the following than you did before the pandemic? (NET = % More - % Less)*

Eating in, wearing masks during flu season, and shopping online were the top three behaviors that seem destined to be a fixture of the “new normal” even after COVID-19 has been eradicated. Meanwhile, shaking hands, hugging, going to concerts, air travel and dining out are going to continue to see significant drops in adoption. When looking at age groups, Gen Zers (those born between 1997 and 2012) stood out. Most are likely to continue cooking at home after COVID, followed by consuming electronic media, wearing a mask during flu season and shopping online. In fact, over 30% of Gen Z and Millennials say they will continue to shop more online post-pandemic. But GenZers are actually sharply divided. While a larger proportion plan to continue staying home, Gen Zers are also the most likely among all age groups to leave the house—with going to the gym, dining out and shopping in stores as standout examples.

That contradictory behavior aside (here’s to hoping Gen Zers make their minds up eventually), the majority of consumers reflect a seemingly permanent shift to online as the ‘default’ channel for shopping across a broad range of demographics.*

*10/9/20 please note, a prior version of this chart incorrectly represented ‘working out’ and ‘in-store shopping’ as ‘-1.’ ‘-10’ is the correct number for each category.

How much are you shopping online now versus before the pandemic?

Number of consumers doing more than half of their shopping online

More than half of consumers (54%) report shopping online more often versus pre-pandemic. In fact, 51% of consumers who see themselves as in the “early stages” or “in the midst” of the pandemic expect to online shop more often after the pandemic is over. This number only drops to 41% among consumers who are “back to normal”—a sign that ecommerce penetration isn’t going to see a significant post-pandemic dip. But the extent to which this behavior has sustained this long is somewhat surprising: the number of consumers who said they do more than half of their shopping online now sits at 45%. That’s nearly 3x pre-pandemic adoption as we approach the all-important holiday peak season.

A few more nuggets we are exploring in other posts:

- 73% of consumers who are shopping online more since the start of the pandemic found they enjoyed it more than they expected.

- 28% of consumers are shopping online more for new brands or sites they have never visited before (led by nearly 40% of Gen Z).

- Where they’re shopping more (% of consumers):

Amazon: 55%

Walmart: 36%

Online marketplace besides Amazon 35%

Small or local businesses: 24%

Target: 22%

Big box stores: 14%

Online or DTC brands: 12%

Department stores: 11%

- 44% of consumers believe that another pandemic will impact their communities in their lifetime. 38% don’t know what will happen.

Looking for a leading indicator of Q4 spending, we asked consumers about their paychecks. 58% reported their income levels remaining about the same, 11% saw an increase, and nearly a third saw their pay decrease versus prior to the pandemic.

For those whose incomes have diminished, the prospect of another government stimulus check may hold promise. 41% of consumers expect another stimulus bill from the government, versus 28% who don’t expect one. If that stimulus bill includes a check, consumers report they will spend the money somewhat cautiously:

- Groceries: 31%

- Invest, save: 21%

- Pay off credit cards or pay down debt: 19%

- Don’t know/Undecided: 11%

- Personal items: 7%

- Home improvement: 6%

- Entertainment/Travel: 4%

So far, this much is clear: consumers may be measuring how much they’ll spend this peak season (in the midst of all else)—but their shopping behaviors will never look the same again.

We have so much left to learn. Welcome to BOXpoll.

BOXpollTM by Pitney Bowes, a weekly consumer survey on current events, culture,and ecommerce logistics. Conducted by Pitney Bowes with Morning Consult //2094 US consumers surveyed October 2021.© Copyright Pitney Bowes Inc.