Defining “fast” and “too far” above the 49th parallel north

BOXpoll is back! This month, we’re focusing our attention on the Great White North, looking at Canadian consumer expectations and the state of the ecommerce market:

- What counts as “fast delivery” in 2023?

- How far are consumers willing to travel to drop off an online return?

- Where are the opportunities for Canadian brands (and US brands selling into Canada) as they adjust to a post-COVID, pre-recessionary environment, battling rising costs and shrinking bandwidth?

Definition of fast

Retailers can breathe easy knowing that consumers’ generous 2022 expectations were not an anomaly—delivery speed expectations have remained virtually the same since we polled Canadian consumers last summer.

To Canadian shoppers, the average definition of “fast” for all non-grocery online orders remains almost 4 days, double the 2-day standard that certain logistics giants would have you believe.

Returns drop-off

We polled consumers in both Canada and the US about returns drop-off distance—specifically, the furthest they’d be willing to drive and how far they actually drive to drop off an online return. This data can help inform the size of the drop-off network online retailers need to achieve returns convenience for most of their customers.

The average Canadian consumer typically travels less than 6 km and is willing to go almost 9 km for a return drop-off—less than Americans, who drive further distances, are more likely to own cars, and thus are willing to go a little farther (14 km, or 8.7 miles). Community population density also impacts returns drop-off distance, with rural Canadians willing to travel a full 3 km further than city-dwellers.

However, previous BOXpoll research reveals the need for efficient drop-off networks that reduce consumers’ travel, in turn optimizing costs for retailers by keeping return cycle times low:

- The average consumer collects multiple online returns before making the trip for drop-off. In cases where packages need to go to different carriers (groan), the total distance covered for returns can exceed the consumers' total desired travel distance of 9 km.

- Perceived inconvenience can contribute to consumer procrastination and longer trunk times, creating a drag on retailers’ inventory costs, eroding margins, and contributing to uncertainty around labor and space planning.

Post-COVID ecommerce market

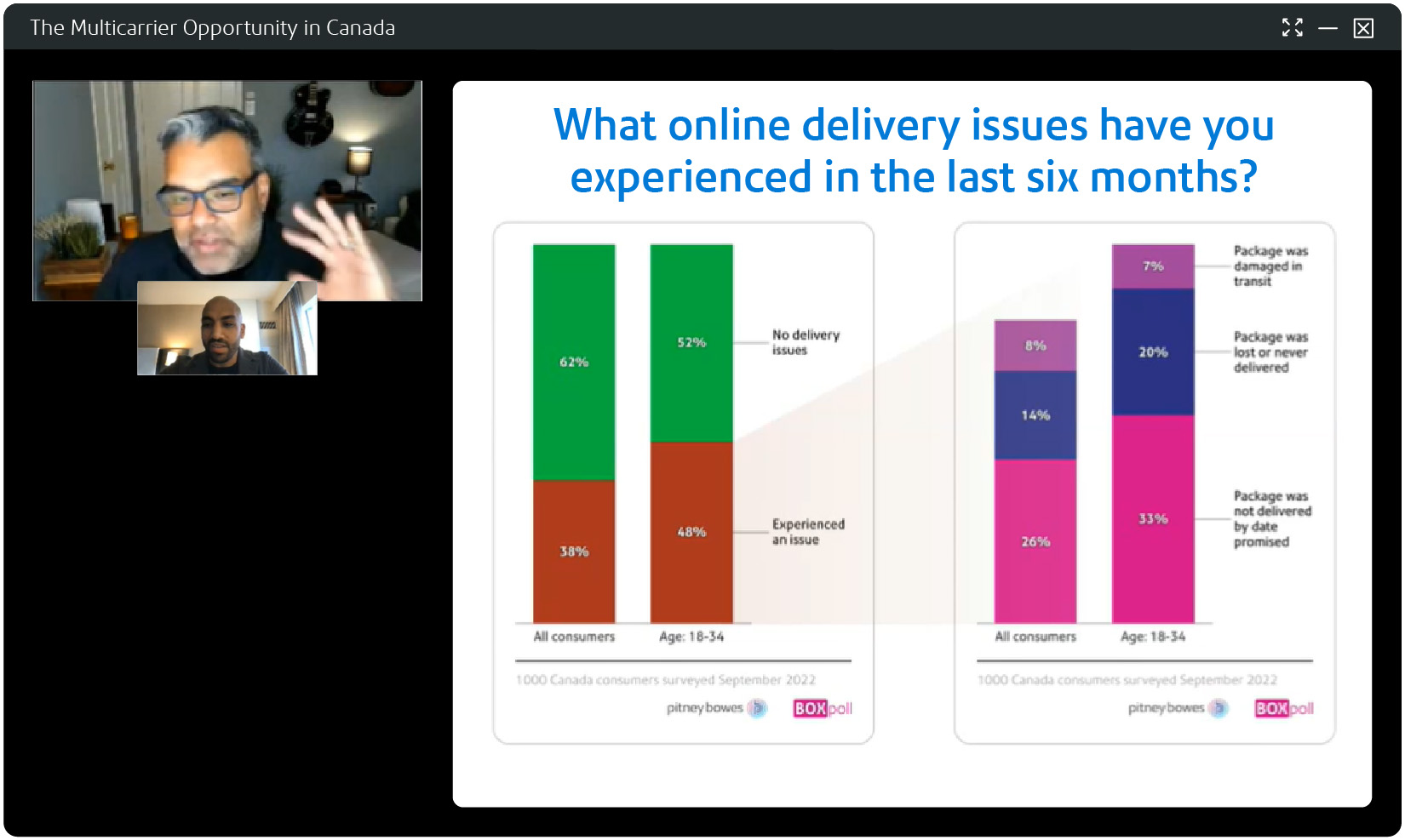

For a deeper dive into Canadian consumers’ current ecommerce expectations and how retailers can adjust to the post-COVID ecommerce market amid rising costs and shrinking bandwidth, check our recent webinar with Retail Dive: The Multicarrier Opportunity in Canada.

BOXpoll™ by Pitney Bowes, a weekly consumer survey on current events, culture, and ecommerce logistics. Conducted by Pitney Bowes with Morning Consult // 1000 Canada consumers surveyed April 2023. © Copyright Pitney Bowes Inc.