Santa’s hunting for discounts

Image caption: “surrealist image of several sets of hands pulling on a rope in a game of tug of war” as prompted by Pitney Bowes. Artwork by DALL-E / Courtesy OpenAI, edited by Pitney Bowes.

It’s the most wonderful time of the year… for people who aren’t trying to forecast ecommerce peak demand amid inflationary pressures, a return to brick-and-mortar stores, and the inability to rely on data from 2020’s and 2021’s peak seasons as reliable guides. This month on BOXpoll, we take a look at consumers’ plans for the rapidly approaching holiday season.

Key takeaways:

- Ecommerce isn’t just holding its ground against in-store shopping this holiday season—it’s gaining. While half of consumers plan to stick with their routine from last year, the share of people buying online more this year (29%) outweighs those shopping online less (20%) by 9%. As inflation tightens household budgets, consumers are turning online for deals—and finding them, thanks to early and aggressive holiday promotions by giants Amazon, Walmart and Target.

- The net increase for online shopping grows even higher when you zoom in on Gen Z (+20%) and Millennials (+19%). Younger consumers are especially likely to turn online this year because they’re both more comfortable with online shopping and more likely to buy from digitally native brands that advertise on Instagram and TikTok and don’t have brick-and-mortar stores.

- Of the consumers who plan to shop online less online this year, the vast majority (71%) cite cutting back on spending altogether as their main reason. Only a quarter (25%) say a preference for in-store shopping has them shopping online less this year.

- While household budgets are top of mind this holiday season, we’d be remiss if we didn’t mention our finding that consumers consistently rank the convenience of online shopping as their number one reason to buy online. Online retailers that can walk and chew gum at the same time (i.e., offer enticing promotions without sacrificing any aspect of customer experience) will be best positioned this holiday season.

Key takeaways:

- More than half of all consumers (51%), three-quarters of Gen Z (75%) and two-thirds of Millennials (68%) say holiday markdowns online will incentivize them to buy more of some items than usual.

- Parents—whose holiday shopping lists are almost certainly longer than their counterparts’—are almost twice as likely than non-parents to buy more discounted items online than they would normally.

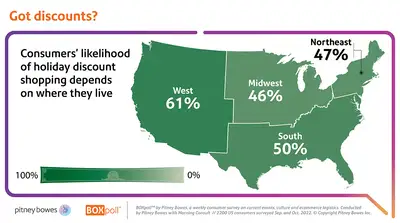

- Respondents who live in cities or in the West—some of the most expensive places to live, as well as the hardest hit by inflation—are also especially likely to buy more discounted items this year. It makes sense that the consumers seeing the highest rates of inflation are the ones doing the most discount hunting.

Online retailers that can walk and chew gum at the same time (i.e., offer enticing promotions without sacrificing any aspect of customer experience) will be best positioned this holiday season.

Early birds… who aren’t any earlier than last year

While the prevailing wisdom dictates that consumers intend to shop earlier this year to find the best discounts and fight back against inflation, our annual holiday trackers don’t yet show that consumers are doing their online holiday shopping any earlier than last year. We’ll be keeping a close eye on how these trends develop in the coming weeks.

BOXpoll™ by Pitney Bowes, a weekly consumer survey on current events, culture, and ecommerce logistics. Conducted by Pitney Bowes with Morning Consult // 2200 US consumers surveyed September and October 2022. © Copyright Pitney Bowes Inc.