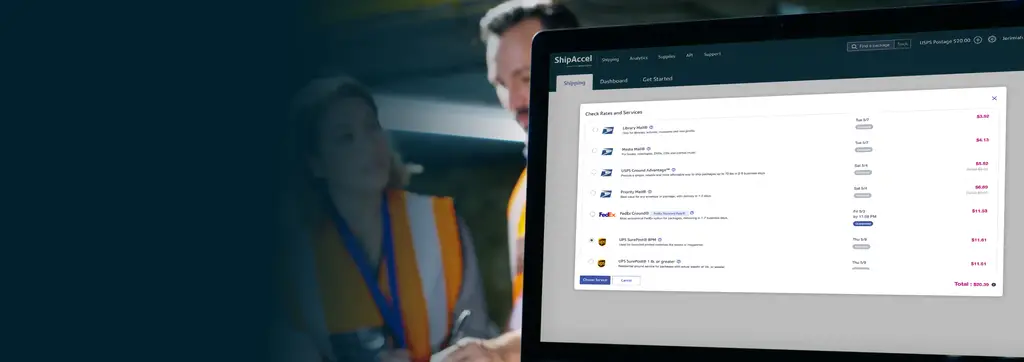

Introducing ShipAccel, Powered by Pitney Bowes.

Backed by 100 years of innovation, ShipAccel is the trusted ecommerce shipping solution you need to scale your business.

Harness the power of 80+ integrations and advanced analytics to reduce costs, automate workflows, and drive exponential growth.

Learn all the ways Pitney Bowes can help make your shipping and mailing easier.

Make smarter shipping decisions with multicarrier software that allows you to effortlessly compare rates, print shipping labels or postage, and save from wherever you’re sending.

Mix-and-match ecommerce logistics services like fulfillment, delivery, returns and cross-border with the ability to reach every address in the US and 200+ countries abroad.

Easily send letters, large envelopes, and packages directly from your office or mail center, all while getting automatic postage savings.

Discover deeper discounts and extend your reach with our nationwide network of 30+ Presort Services operating centers.